A GST Calculator is an invaluable online tool designed for calculating the Goods and Services Tax (GST) applicable on various goods and services in countries where GST is implemented. GST calculator simplifies the task of determining the GST amount to be added to or deducted from the base price, making it an essential utility for businesses, accountants, and individuals dealing with GST-inclusive or exclusive pricing.

How the GST Calculator Works

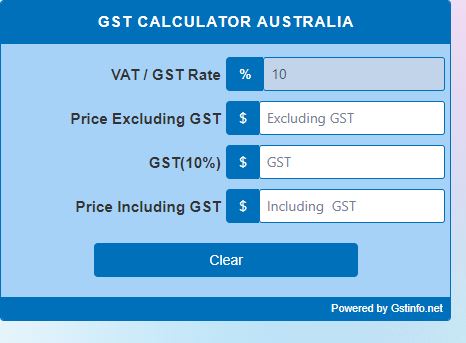

Operating a GST calculator involves entering the net price (price without GST) of a product or service. The user then selects the applicable GST rate. The calculator computes the GST amount and provides the gross price (total cost including GST) or net price (price excluding GST), based on the input. This straightforward mechanism eliminates manual calculation errors, ensuring accuracy and efficiency.

Benefits to Users

- Accuracy and Efficiency: Automates calculations, reducing human error.

- Time-Saving: Quick computations allow users to focus on other tasks.

- Compliance Aid: Helps ensure correct GST application, avoiding legal penalties.

- Financial Planning: Offers clear insights into tax liabilities or credits, aiding in better financial management.

Importance of GST

GST streamlines the tax structure by amalgamating several indirect taxes into a single tax, reducing the cascading effect of taxes, thereby making goods and services slightly more affordable to the consumer. It enhances transparency, increases tax compliance, and boosts revenue for the government, contributing to economic development.

GST in New Zealand vs VAT in India

Goods and Services Tax (GST) systems in New Zealand and India serve as key components of each country’s economic framework, designed to streamline taxation on goods and services. However, the implementation, structure, and impact of GST in these countries differ significantly due to their distinct economic policies, tax objectives, and administrative complexities.

New Zealand’s GST

New Zealand introduced its GST in 1986, implementing a single, comprehensive indirect tax system. Here are some key features:

- Flat Rate: New Zealand’s GST is characterized by a single flat rate, which is currently 15%. This simplicity in the tax rate facilitates ease of understanding and compliance among businesses and consumers alike.

- Broad Base with Few Exemptions: The GST in New Zealand covers almost all goods and services with very few exemptions, such as financial services, residential rent, and donations. This broad base ensures a wide tax net, minimizing economic distortions and promoting fairness.

- Inclusive Pricing: Prices in New Zealand are generally GST-inclusive, which means the displayed price is what consumers pay, making it straightforward for consumers to understand the total cost of purchases.

- Input Tax Credit: Businesses can claim input tax credits for GST paid on their purchases, which helps in avoiding the cascading effect of taxes and ensures that the tax is ultimately borne by the end consumer.

GST in India

India’s GST, implemented on July 1, 2017, was a significant reform in the Indian tax system, replacing a complex structure of multiple indirect taxes with a unified framework. It introduced several novel features to address India’s diverse economy:

- Multi-tiered Rate Structure: Unlike New Zealand’s flat rate, India adopted a multi-tiered GST structure with rates of 0%, 5%, 12%, 18%, and 28% applied to different categories of goods and services based on their essential nature. Special rates are also applied to precious stones, gold, and luxury items, and there’s a cess for demerit goods like tobacco.

- State and Central GST: India’s GST is divided into Central GST (CGST) and State GST (SGST) for intra-state supplies, with Integrated GST (IGST) levied on inter-state supplies and imports. This dual model was designed to accommodate India’s federal structure, ensuring revenue sharing between the central and state governments.

- Complex Compliance Mechanism: The compliance mechanism under India’s GST is more complex, with businesses required to file monthly and annual returns. The introduction of the e-way bill and the requirement for invoice matching add layers of compliance not seen in New Zealand’s GST system.

- Exemptions and Thresholds: India provides exemptions for certain goods and services and has a higher threshold for GST registration (₹20 lakh for most states and ₹10 lakh for special category states), aiming to reduce the compliance burden on small businesses.

Comparative Analysis

- Simplicity vs. Complexity: New Zealand’s GST system is lauded for its simplicity, with a single rate and inclusive pricing. In contrast, India’s GST, while simplifying the earlier tax regime, introduced a multi-tiered rate system and a dual GST model, adding to the compliance complexity.

- Economic Integration: Both systems aim to integrate their economies and reduce tax-induced distortions. However, India’s model also seeks to address economic disparities and promote social equity through its differentiated rate structure.

- Administrative Efficiency: New Zealand’s GST is easier to administer due to its straightforward design. India’s GST, with its multiple rates and dual structure, presents administrative challenges, although it’s significantly improved the tax collection process compared to the pre-GST era.

Conclusion

Both New Zealand and India’s GST systems reflect their respective country’s policy objectives, economic structures, and administrative capabilities. New Zealand’s GST is a model of simplicity and efficiency, making it one of the easiest to comply with and administer. India’s GST, while more complex, represents a monumental step towards unifying the country’s fragmented tax system, aiming to boost economic growth, increase revenue, and make the Indian market more integrated and competitive on a global scale.

GST’s Role in Filing, Returns, and Refunds

GST filing and returns are critical for maintaining compliance with tax laws. Accurate GST calculation ensures that businesses report their taxes correctly, avoiding penalties. The process allows businesses to claim GST credits on their purchases, effectively reducing the cost of inputs and improving cash flow. In cases of excess GST payment, businesses and individuals are eligible for GST refunds, which can be significant for operational liquidity.

Conclusion

The GST calculator represents a convergence of technology and taxation, offering a pragmatic solution to the complexities of calculating consumption taxes. Its role transcends mere calculation, touching on legal compliance, financial planning, and economic efficiency. As global economies continue to evolve, tools like the GST calculator will remain indispensable for navigating the intricate world of taxation, embodying the principles of accuracy, efficiency, and transparency.