Introduction: Why Accounting Firms Need Management Software

In today’s fast-paced financial landscape, accounting firms face growing challenges, including handling multiple clients, managing complex financial data, and ensuring compliance with regulatory standards. Manual accounting workflows can be tedious and error-prone, leading to inefficiencies and lost revenue. This is where accounting practice management software proves to be a game-changer.

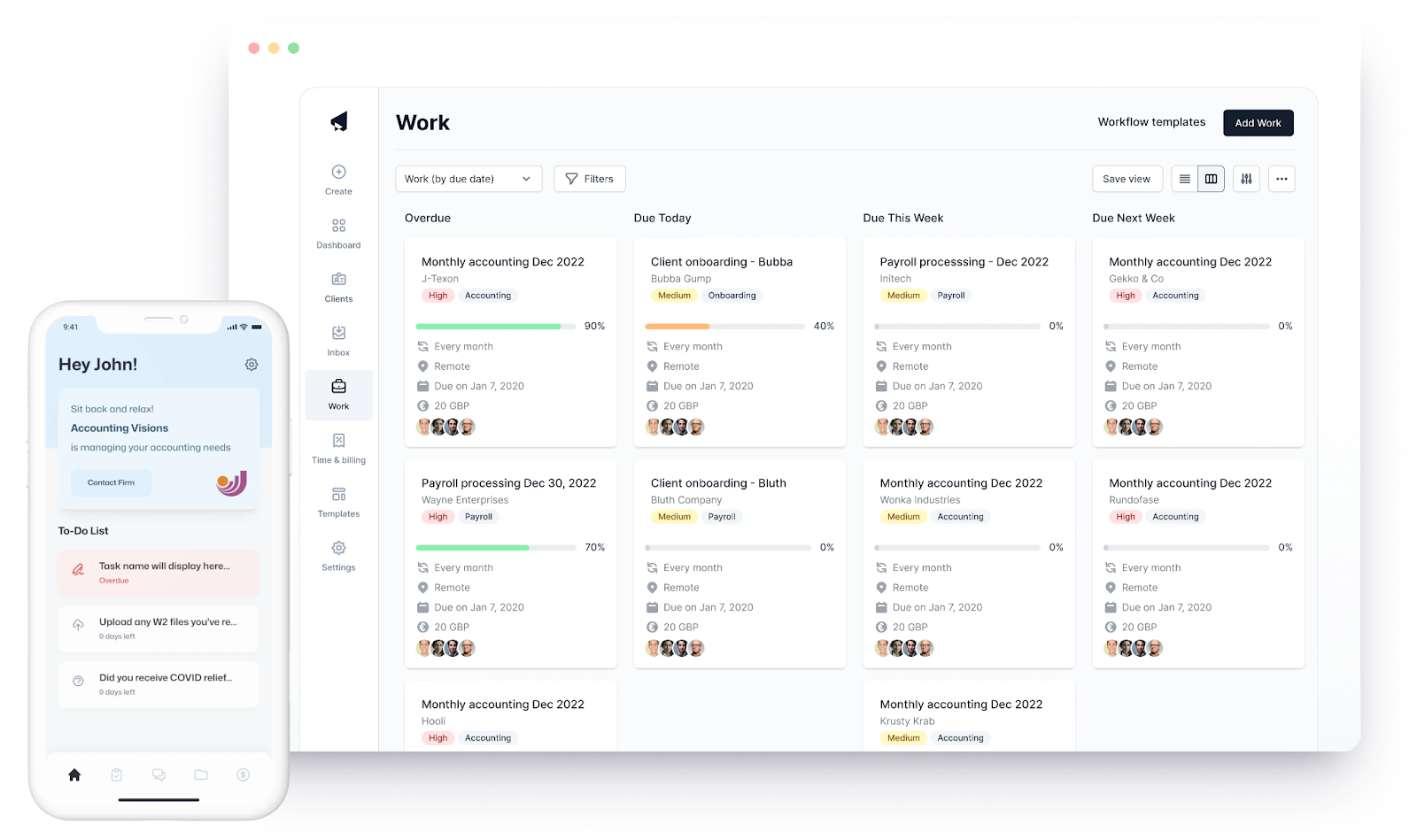

These software solutions are specifically designed to help accounting professionals streamline workflow, automate repetitive tasks, improve collaboration, and manage client relationships effectively. Whether it’s tracking deadlines, organizing client information, or simplifying invoicing, accounting practice management software acts as a central hub for managing an accounting firm’s day-to-day operations. With cloud-based accessibility and AI-powered automation, these tools enhance efficiency and accuracy, ensuring that accountants can focus on delivering high-value financial services rather than administrative burdens.

Benefits of Accounting Practice Management Software

One of the biggest advantages of using accounting practice management software is the automation of repetitive tasks. Firms can set up automated reminders for client follow-ups, tax deadlines, and document submissions, reducing the risk of errors and improving efficiency.

Centralized Client Information

Accounting firms handle multiple clients, and managing their financial data manually can be overwhelming. With practice management software, all client details, financial records, and communication history are stored in a centralized system, making it easier to retrieve information when needed.

Seamless Collaboration Among Teams

With remote work becoming more common, seamless collaboration is crucial. These tools offer features such as real-time task tracking, shared calendars, and internal messaging systems, ensuring that accountants, auditors, and tax professionals can work together efficiently, regardless of their location.

Time Tracking and Billing Management

For firms that charge clients based on billable hours, time tracking is essential. Most accounting practice management software options come with built-in time tracking and billing features, allowing firms to generate accurate invoices and improve cash flow.

Secure Document Storage and Compliance Management

Handling financial data requires strict adherence to compliance regulations. These tools offer encrypted cloud storage, role-based access control, and automatic backup features to protect sensitive financial documents and ensure compliance with industry standards such as GDPR and SOX.

Improve Client Communication

Many practice management tools provide client portals where accountants can securely share documents, exchange messages, and schedule meetings. This improves transparency and strengthens client relationships by ensuring smooth communication.

Top Practice Management Software Options For Accountants

Cone

Cone is a modern accounting software designed to simplify financial workflows, automate tasks, and improve data accuracy for accounting firms.

Sage Intacct Accountants Program

Sage Intacct offers cloud-based financial management with real-time reporting, making it ideal for firms handling large volumes of client transactions.

Karbon

Karbon provides an integrated platform for task automation, workflow tracking, and client collaboration, ensuring seamless accounting operations.

Jetpack Workflow

Jetpack Workflow is a project management tool for accountants, allowing them to track tasks, deadlines, and client requests in one place.

Canopy

Canopy helps firms manage tax resolution, document storage, and CRM functionalities, making client interactions more organized and efficient.

TaxDome

This all-in-one accounting software offers tools for document management, invoicing, and secure client communication, enhancing workflow efficiency.

Aero Workflow

Aero Workflow focuses on structured task management and process automation, ensuring that accountants stay productive without missing deadlines.

Financial Cents

With an intuitive dashboard, Financial Cents simplifies project tracking, improves time management, and enhances overall firm efficiency.

Pixie

Pixie is a simple yet powerful accounting practice management tool that helps small firms streamline operations and manage client interactions effectively.

Mango Practice Management

Mango provides a user-friendly platform for accountants to automate invoicing, manage projects, and securely store financial documents.

Firm360

A comprehensive cloud-based solution, Firm360 offers practice management tools that improve task organization, collaboration, and reporting.

Senta

Senta is designed for growing firms, providing features like workflow automation, compliance tracking, and a powerful CRM system.

How to Choose the Right Accounting Practice Management Software

1. Identify Your Firm’s Needs

Before selecting a software solution, assess your firm’s workflow requirements. Do you need advanced automation, a client portal, or integration with other accounting tools like QuickBooks or Xero? Understanding your needs helps in making an informed decision.

2. Look for Scalability

As your accounting firm grows, so do its operational requirements. Choose software that can scale with your business, offering additional features and integrations as needed.

3. Prioritize Security Features

Since accounting firms handle sensitive financial data, security should be a top priority. Look for software that offers encrypted document storage, two-factor authentication, and regular backups to prevent data breaches.

4. Evaluate Ease of Use

A complex and difficult-to-navigate system can slow down operations. Opt for an intuitive and user-friendly interface that requires minimal training for your team to use efficiently.

5. Consider Customer Support and Training

Reliable customer support ensures smooth implementation and troubleshooting. Choose software providers that offer training, 24/7 support, and resources to help your firm maximize its benefits.

Conclusion

The accounting industry is rapidly evolving, and firms that embrace digital transformation gain a competitive advantage. Accounting practice management software not only enhances operational efficiency but also ensures compliance, improves client relationships, and boosts profitability.

With features like automation, secure document storage, and real-time collaboration, these software solutions are becoming essential tools for modern accounting firms. By selecting the right software tailored to your firm’s needs, you can streamline processes, reduce administrative burdens, and focus on delivering high-quality financial services to your clients. Investing in the right technology today will ensure long-term growth and success in the ever-changing financial landscape.